The Indian tax system is evolving, and with 2025 on the horizon, significant updates to Tax Deduction at Source (TDS) rules are expected to impact individuals and businesses alike. What does this mean for your finances, and how can you stay compliant in the changing landscape of tax deductions? Explore the upcoming shifts and understand how these will affect your tax obligations, from revised thresholds to enhanced transparency measures.

Stay informed to optimize your tax planning strategy!

Everything You Need to Know About Tax Deduction at Source (TDS)

Contents

Tax Deduction at Source (TDS) is a key feature of the Indian taxation system, and while it might seem like a complicated concept, understanding it is crucial for both individuals and businesses. Whether you’re a salaried employee, a contractor, or an investor, TDS impacts you in one way or another. In this blog, we’ll break down everything you need to know about TDS in simple terms—so let’s dive right in!

What is TDS?

TDS is exactly what it sounds like – a deduction of tax at the very source of income. It means that before you receive any payment (whether it’s salary, commission, or interest), a certain percentage of that amount is deducted by the payer and sent directly to the government. It’s like the government is collecting its share of the tax before you even get paid, ensuring that you pay your taxes promptly.

WHO DEDUCTS TDS?

TYPICALLY, TDS IS DEDUCTED BY:

- Employers (from employees’ salaries)

- Banks (from interest income)

- Business owners (on payments to contractors, consultants, etc.)

- Government (on various transactions like rent, professional fees, etc.)

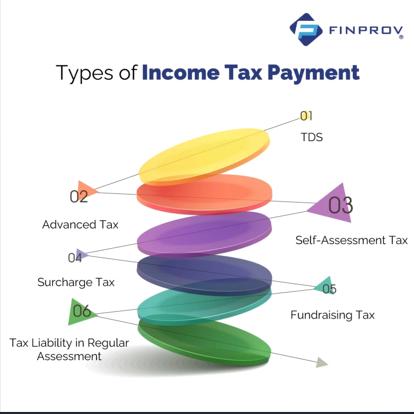

TDS isn’t just about salary deductions. It applies to a wide range of income sources. Some of the common categories include:

TYPES OF INCOME SUBJECT TO TDS?

- Salaries (Section 192): Employers deduct TDS from employees’ salaries based on the applicable income tax slabs.

- Interest on Bank Deposits (Section 193): If you have a fixed deposit or earn interest from your savings account, TDS is deducted by the bank.

- Rent (Section 194I): If you’re paying rent for property or equipment, the landlord may deduct TDS.

- Professional Fees (Section 194J): Payments made for professional services, like consultancy or legal services, are subject to TDS.

- Commission or Brokerage (Section 194H): If you’re receiving commission or brokerage, TDS is deducted from that amount.

TDS RATES: HOW MUCH WILL BE DEDUCTED?

The rate at which TDS is deducted depends on the type of payment you’re receiving and the applicable tax laws. Here are some examples of TDS rates:

- Salary: TDS is based on the individual’s income tax slab. The more you earn, the higher the rate of TDS.

- Interest from Bank Deposits: Generally, 10% (if PAN is provided).

- Rent: 10% for rent on property, 2% for rent on machinery.

- Professional Fees: 10% for payments to professionals (like consultants or doctors).

It’s important to note that these rates may change and could be subject to exemptions or reductions under specific circumstances. Make sure you’re aware of the current rates and deductions.

WHY IS PAN IMPORTANT FOR TDS?

When TDS is deducted, your Permanent Account Number (PAN) plays a crucial role in the process. If you provide your PAN to the payer, the TDS will be deducted at the applicable rate (usually lower). If you don’t provide your PAN, the TDS rate can go as high as 20%. So, always ensure your PAN is available for any transactions involving TDS to avoid paying more than necessary.

TDS CERTIFICATES: PROOF OF TAX DEDUCTED

Once TDS is deducted from your income, the payer provides you with a certificate. This certificate serves as proof of the tax that’s been paid on your behalf. There are two key forms:

- Form 16: This is for salaried individuals, detailing the TDS deducted from your salary.

- Form 16A: This is for non-salaried individuals (for example, contractors, consultants, or those receiving commission), detailing TDS deducted on non-salary payments.

Keep these certificates safe—they’ll be essential when you file your income tax return.

HOW TO CHECK YOUR TDS STATUS

You might wonder, “Has my TDS been deducted and paid to the government?” To check this, you can refer to your Form 26AS, which provides a consolidated summary of all TDS transactions for a financial year. This form is available on the Income Tax Department’s website and will show you whether the TDS deducted by the payer matches what has been deposited with the government.

You can also track your TDS using the TRACES portal (Tax Information Network), which lets you verify your TDS details and download your TDS certificates.

WHAT HAPPENS IF TDS IS DEDUCTED INCORRECTLY?

If the TDS deducted exceeds your actual tax liability, you can claim a refund from the Income Tax Department when you file your income tax return. Just remember to file your return on time, and the excess tax will be refunded to you after the necessary processing.

On the flip side, if TDS isn’t deducted or deposited correctly, you or the payer might face penalties or interest charges. In the worst-case scenario, you could even lose out on deductions for certain expenses if TDS isn’t deducted when necessary.

KEY TAKEAWAYS: TIPS FOR TDS

- ALWAYS PROVIDE YOUR PAN: This helps ensure the correct TDS rate is applied.

- CHECK YOUR FORM 26AS: To make sure that the TDS deducted by the payer matches with the government’s records.

- File your tax return on time: If too much TDS has been deducted, you can claim a refund.

- Keep TDS certificates safe: They’re proof of the tax paid on your behalf.

CONCUSION

TDS might seem complicated at first, but once you understand the basics, it’s a system that ensures a steady flow of tax revenue while also helping you fulfill your tax obligations throughout the year. Whether you’re earning a salary, receiving interest on a deposit, or getting paid for professional services, understanding how TDS works is crucial. So, stay informed, keep track of your TDS, and always file your returns on time!

DPV NATION